|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Bankruptcy Attorney NH: Navigating Financial Challenges

When financial hardships become overwhelming, seeking the assistance of a bankruptcy attorney in NH can provide a lifeline. This article explores the role of bankruptcy attorneys, the types of bankruptcy, and essential considerations when choosing legal aid in New Hampshire.

Role of a Bankruptcy Attorney

A bankruptcy attorney specializes in providing legal advice and representation to individuals facing financial distress. Their expertise includes guiding clients through the complexities of bankruptcy filing and ensuring compliance with legal requirements.

Responsibilities

- Evaluate the client's financial situation

- Determine the most suitable type of bankruptcy

- Prepare and file necessary documentation

- Represent clients in court proceedings

Importance of Expertise

Hiring an experienced attorney can significantly impact the outcome of a bankruptcy case. They provide critical insights into legal procedures, potential outcomes, and effective strategies for debt relief.

Types of Bankruptcy

Bankruptcy law offers several options, each tailored to different financial situations. Understanding these options can help individuals make informed decisions.

Chapter 7 Bankruptcy

Also known as liquidation bankruptcy, Chapter 7 involves selling non-exempt assets to repay creditors. It provides a fresh start by discharging most debts.

Chapter 13 Bankruptcy

Chapter 13 involves a repayment plan over three to five years, allowing individuals to keep their assets while gradually repaying debts. This option is often sought by those with a steady income. For more details, you can visit chapter 13 bankruptcy Alabama.

Choosing the Right Bankruptcy Attorney

Selecting the right attorney is crucial to successfully navigating the bankruptcy process.

Factors to Consider

- Experience: Look for attorneys with a proven track record in bankruptcy cases.

- Reputation: Research client reviews and seek recommendations.

- Fees: Understand the attorney's fee structure and ensure it aligns with your budget.

- Communication: Choose an attorney who communicates clearly and regularly.

Making the right choice can ease the stress of bankruptcy proceedings and improve the likelihood of a favorable outcome. If you're unsure whether bankruptcy is right for you, you might find it helpful to explore whether can I file bankruptcy for more guidance.

Frequently Asked Questions

What is the first step in filing for bankruptcy in NH?

The initial step is consulting with a qualified bankruptcy attorney to assess your financial situation and determine the best course of action.

How does Chapter 7 bankruptcy differ from Chapter 13?

Chapter 7 involves liquidating assets to discharge debts, whereas Chapter 13 allows for a repayment plan to retain assets while managing debt.

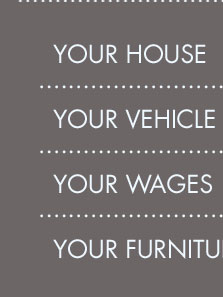

Can I keep my home if I file for bankruptcy?

In many cases, individuals can keep their homes by filing for Chapter 13 bankruptcy and maintaining regular payments under the repayment plan.

Understanding the intricacies of bankruptcy and the role of an attorney can significantly influence financial recovery. With the right guidance, individuals can navigate these challenges and work towards a more stable financial future.

The experienced bankruptcy and business law attorneys at Ford, McDonald & Borden, P.A., are well-respected in the New Hampshire legal arena.

In New Hampshire, there are two ways you can file for bankruptcy Chapter 7 and Chapter 13. How you need to file depends upon several factors. The bankruptcy ...

Your New Hampshire Bankruptcy Attorney. A different kind of law firm where you will be heard. Where you will be guided every step of the way personally by.

![]()